Did you know that the IRS plans to implement paperless processing for all tax returns by 2025? They aim to cut processing times in half, expediting refunds by weeks.

If you don’t have an integrated digital tax workflow solution, you’ll be wasting a lot of time — for you and your clients. Besides being inefficient, there’s a lot of unnecessary paper that’s wasted in producing physical tax documents.

Save yourself some time and a few trees. In this article, we’ll show you how to set up a tax digitization workflow that’s totally integrated with your WordPress site.

Start with Fillable PDFs

Gravity Forms is great for creating web forms in WordPress. If you want to expand the functionality to create an efficient and professional tax digitization workflow, then you need Fillable PDFs. It’s a no-code solution that integrates perfectly with Gravity Forms. You and your visitors can fill out tax forms directly on your site and receive an automatically-generated, client-ready PDF.

To get started, download Fillable PDFs. Once you install and activate the add-on, you’re ready to roll.

Use an Existing Tax Form

Let’s start with a simple example. We can set up a form to capture information on a 1099-MISC that we want to send to one of our vendors. Using the existing 1099-MISC from the IRS, we can generate a completed PDF and send it directly to the vendor. With Fillable PDFs it only takes five easy steps:

Step 1: Download and prepare the 1099 form

You can grab the official 1099-MISC from irs.gov. The form is a multiple page PDF, so you should first delete any pages that aren’t the actual form. The PDF already contains fillable fields, so you don’t have to do that work.

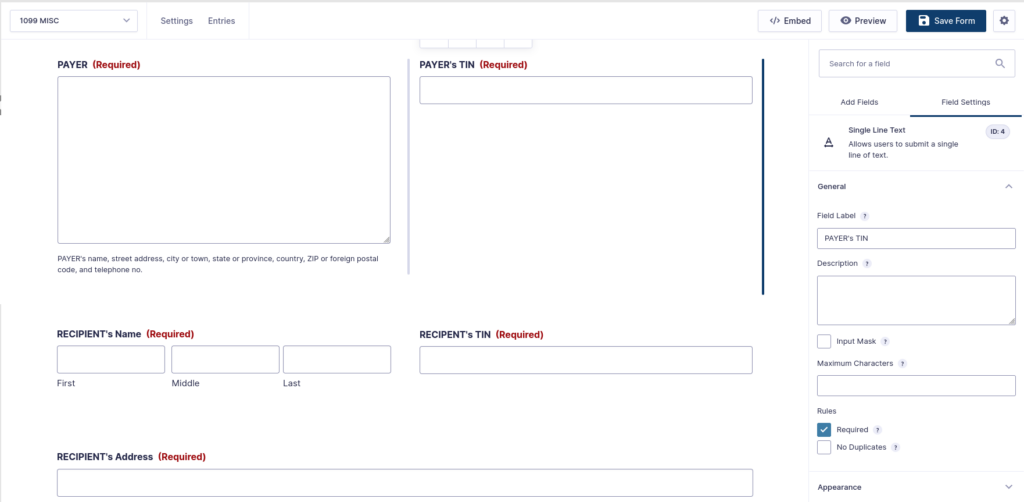

Step 2: Create the web form

You’ll need to create a form using Gravity Forms that includes all the same fields as the 1099-MISC PDF.

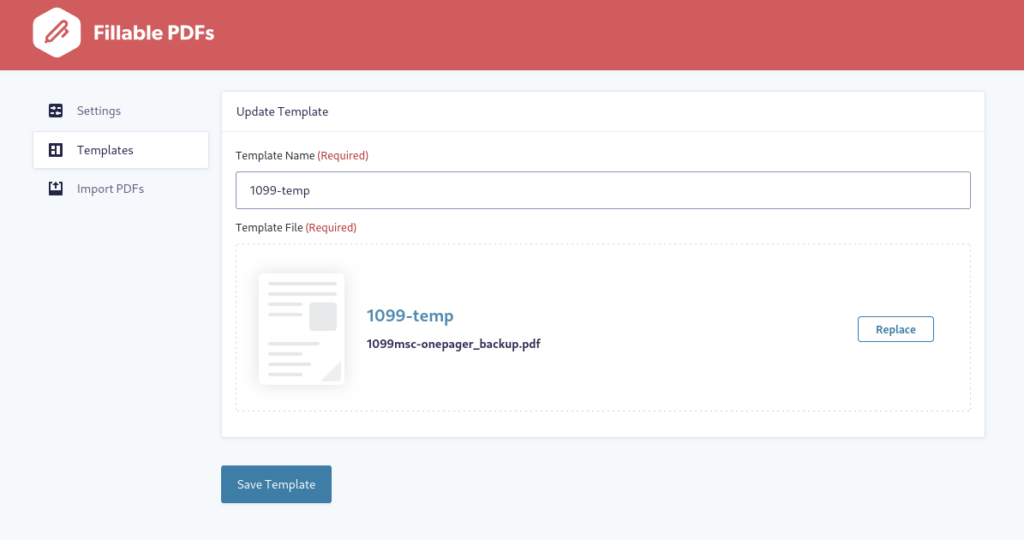

Step 3: Create a template

With Fillable PDFs, you can upload any PDF that has fillable fields and use it as a template. You’ll use this template to map, or sync, your form fields to your web form in Gravity Forms. Navigate to Forms → Fillable PDFs. Select the Templates tab and click Add New. Upload your 1099-MISC PDF and click Create Template.

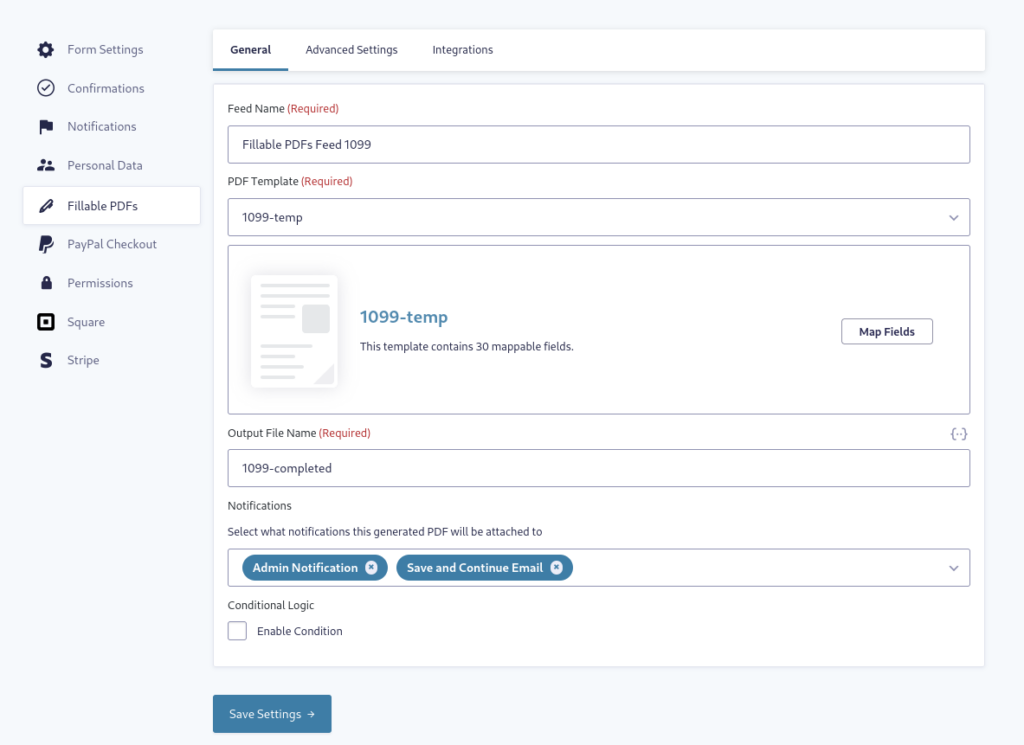

Step 4: Add a Fillable PDFs Feed and map your form fields

In Gravity Forms, go to your list of forms. Hover over your 1099 form, then choose Settings → Fillable PDFs. From the Feeds screen, click Add New to create a feed.

Give your Feed a name, then select the template you’d like to use — in this case, use the 1099-MISC template you just created — and click Map Fields.

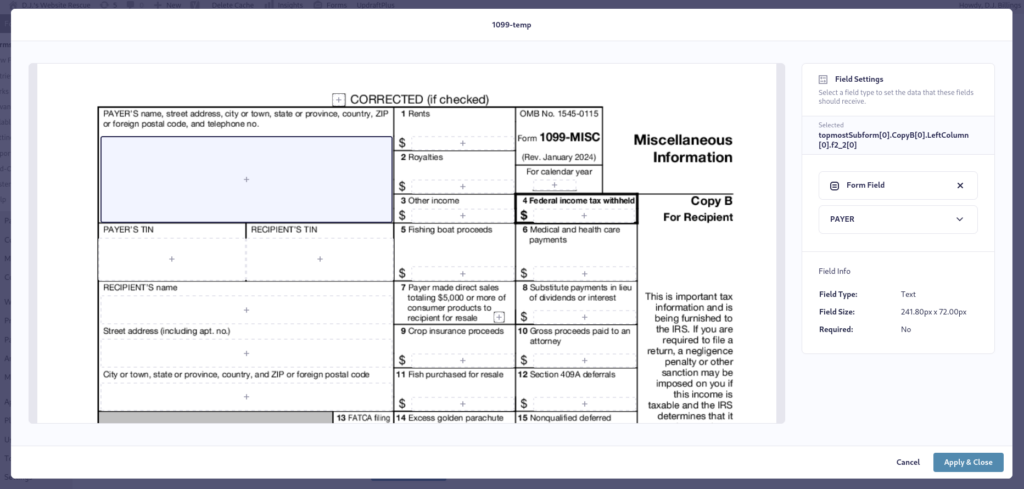

On the next screen, you’ll see your fillable PDF on the left and a menu on the right. On the PDF template, click a field you want to map. On the right, select Form Field, then from the drop-down below, choose the field name that matches it.

When you’re finished mapping all the fields, click Apply & Close. Enter an Output File Name and select any email notifications where you want the generated PDF attached. Make sure you save your settings!

Step 5: Put the form on a page and test

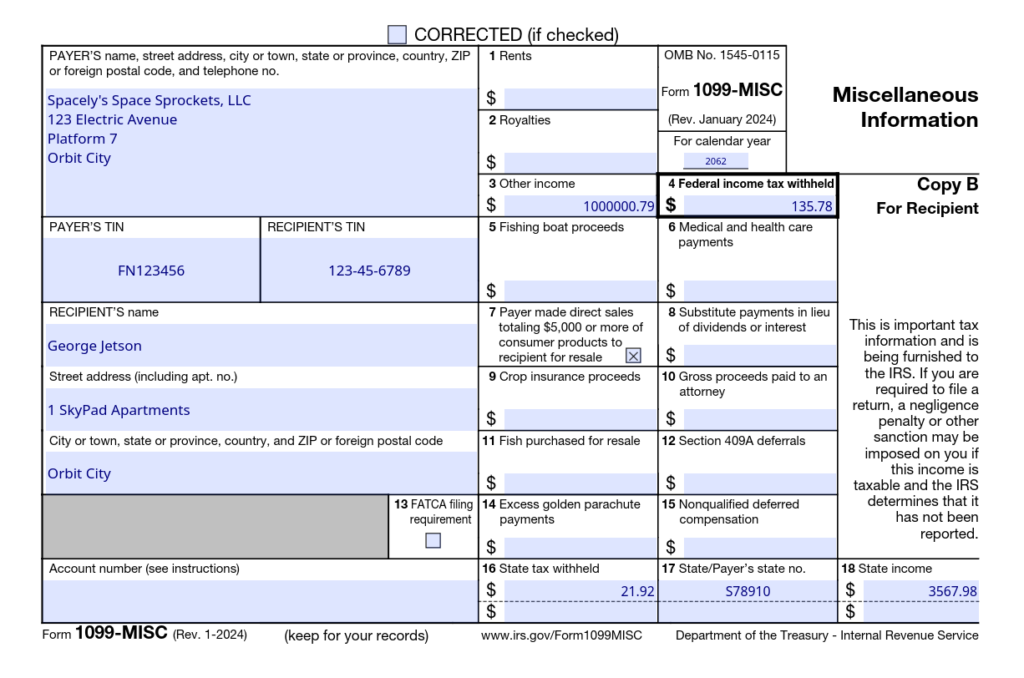

You can effortlessly add your form to any page using the Gravity Forms block. Preview or publish the page, then go ahead and test your form. Once you fill in some fields and submit, a PDF will be generated and emailed — as long as you set that up in the feed. You can also view your entries and download the PDF from inside WordPress. You’ll see that the PDF contains all the information you filled in, in the format of the official IRS 1099-MISC.

You can also set up your form to be emailed directly to your vendor upon submission. Anytime you need to prepare a new 1099-MISC, just head to your form page and fill in the fields. It couldn’t be easier!

Create Your Tax Digitization Workflow in Minutes

Generating a 1099-MISC tax form is only the beginning of a full tax digitization workflow. You can use this same method for any other tax forms you or your visitors need to complete.

You can add Fillable PDFs to your WordPress site and integrate with Gravity Forms in minutes. Grab your copy now!